With the world today being driven by intellectual property and deep technology, there’s an increased and immediate need for getting research evidence into policy and practice – basically getting research adopted by the Industry, startups, new products et al. The importance of getting research used by the stakeholders in leveraging the new technology towards higher value, lowered costs, better products, and solving existing problems cannot be overstated, and yet we find that the challenges seem to be overwhelming the practice.

Prof. Ramesh Loganathan, Head of Research/Innovation Outreach, IIIT-Hyderabad discusses the real-world problems faced by the industry and universities, and how IIIT-Hyderabad is attempting to overcome these issues.

American history shows us that it took them a good 50 years or more to introduce applied science being researched in their universities into advanced industrial technologies. And this was during the Industrial Revolution era. Things haven’t changed much today the world over, even after so many years. Collaboration between academia and industry is still quite limited, and there’s no real-world tried and tested model that’s widely used.

Academic research institutions are very actively engaged in research. Most of the problems are derived from an academic angle and less often driven by industry problems. Post fact, after research is done, many of the research work do have application opportunities in industry. However even these don’t get realized as often as they could.

Several factors come into play that reduces the probability of research being used in industry products and solutions. Here’s a look at some of factors, and some possible mitigating solutions.

What are some typical industry-research engagement models?

– Commissioned research projects

This is when the company commissions a technology research product based on research being done by the university. The main objective of the commission is to assist both the client (the industry in this case) and the researcher by discussing and scoping the project upfront, fixing the commercials, signing the MOU, and then starting the work. This helps reduce the risks of error, omission or misunderstanding and helps improve the quality of the final product.

– Consulting (Industry Projects)

In this model, industry folks have access to the professors and other researchers in the university to discuss their problems and try discussing various modes of working and finding solutions. An example of this at IIITH, is the Nurtural Lab, where the industry pays an upfront amount to the university for access to the professors, but cannot influence the work that is being carried out by the researchers.

– Technology Licensing

This is when a technology licensing agreement by the licensor authorizes the licensee to use the technology under certain agreed terms and conditions. It is, therefore, a contract freely entered into between two parties (in this case between researchers and companies/industry/startups), and contains terms and conditions so agreed. Several independent analysis done over the years suggest that corporate-sponsored research is very valuable for further innovation.

Low levels of industry-research engagements

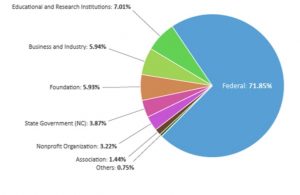

Academic research relies on multiple sources of funding. Government, Corporate, NGOs, etc. Most of the funding however is from government sources. In the US, it’s directly from federal government sources. Likewise in India, most of governmental funding comes from organizations like DST, MEITY & MHRD.

A corollary of corporate funding being so low is that globally the research industry engagement is very low. The fact that most of research funding is received from government sources is an indicator of how minimally industry is engaged in research.

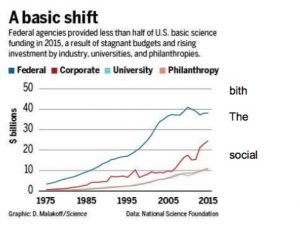

Shift towards corporate/non-governmental sources

While government sources of funding still continues to be the highest, the levels are beginning to flatten and corporate/non-government sources of funding has been growing in recent years.

At IIIT-H in recent years we are seeing a shift both ways. Government funding sources getting difficult, and industry engagement increasing, even as the increase is very constrained. Mostly around commissioned research or social funding. Technology licensing and new product creation continues to still be very low.

Why are industry-research engagements so low?

In spite of there being well-established practices around engaging with industry, the levels of actual engagement are very low across the board. The expectations from industry and the state of research technology in the labs have few critical gaps. All these approaches mentioned above have multiple challenges. Some of these include:

Conflicting demands from industry and faculty

The way the industry works, they do not typically want technology consulting. The industry wants experts who can guide them in solving their problems, and with the assumption that the researcher is already working on the same problem. The researchers on the other hand, are not too thrilled themselves, since this can be very disruptive from their regular work, and they do not find any value in the work that is being done.

The consulting model also has problems because of the lack of structures and mechanisms to have researchers from two sides spend time together. Also, since the clarity on the projects and features is evolving, it becomes difficult for the two sides to work well in a collaborative manner.

Academia setting up collaborations with the industry also tend to be vigilant in their mission to generate and transfer knowledge, and many a times assume that the industry is mainly focused on trying to lock up the intellectual property. This at times make them miss out on great collaborative opportunities.

Evolving scope in industry requirements

A bigger problem with the commissioned projects also are they are not well defined or well contained; many of them being application projects. These projects, most likely being defined from their existing business also require the researchers to have a strong understanding of the domain. The project will also have dependency on the industry data, which at times the company itself is not forthcoming with. This, along with problems like access to internal systems, APIs, people, etc. are always problems that commission projects face.

Hard to discover what is licensable

Problem with technology licensing starts with lack of information on technologies. Academic institutions have well documented list of research works and research publications. While this is a great source of research insights, it doesn’t provide the adoption view of the same. Adoption technologies will arise from research and often one technology may compose of multiple research works and sometimes also on research work generating multiple technologies. Technologies have to state an adoption view, while research presents an academic intellectual view. Rarely are these two interchangeable in their language or definitions. Lack of technology listing is one of the most critical inhibitor of technology licensing.

Where are the prototypes?

In the technology licensing mode, research labs concentrate only on the research work and not much on prototypes, although the industry looks for the prototypes when trying to license/patent the research. Building prototypes can take upto 6 months, and while the researchers would prefer moving onto the next research, the industry also prefers reading the papers and building the prototype on their own.

The industry folks are also, at times, not sure about the knowledge that can be received from the academia. There’s no clarity on what they can ask the labs and research faculty, and how to get help from them.

Research work excites, but not ‘building’ products

A huge challenge is also that researchers scarcely want to start companies of their own, making the startup scene coming from researchers an almost non-existent option. This of course leads to the ever-increasing number of unused patents held by universities and public research institutions. In some cases, a company may come and license the technology. But in most cases companies probably don’t even know such a technology exists. And when they do come across, and engage in a conversation with the research lab, most cases there is no product to consider. The lab has moved on to the next research problem. There’s no one to think about the product possibilities from that research. Much less to look at building the product or the prototype. Research excites. But not products.

Different Expectations & Working Styles

Researchers often want help from industry for collection of real-time data, but this is most times not shared by them, or shared in a form that may not be easily understood by researchers. The objectives of industry and academia are very different from each other, leading to different approaches too. The objective of research in a company is to find knowledge where it can be used to improve business.

Research needs are driven by the objectives of the business for industry, while academicians like to work for various other reasons, such as pursuing personal search interests, social calling, teaching, passion, etc. Today many high-tech companies have their own research labs for developing new products and services.

Researchers like to work independently, and do not expect their work to produce outcomes measured in monetary terms, and with no overachieving agenda. Research done in educational institutes typically have long lead times to publication, whereas the industry research is almost always driven, seeking answers to specific problems and with tight timelines.

Research work done in universities typically have the results limited solely to academic literature, with their success being largely based on publications. The researchers typically move away from the area, once their publication is complete.

The university publications are filled with academic jargons and cannot be easily understood by the engineers in the Industry.

Experiences of IIIT-Hyderabad in increasing industry-academic engagements

IIIT-Hyderabad pretty much faces all the above challenges. By and large the industry engagement levels are very low even for IIITH research labs. The founding philosophy of IIIT-Hyderabad is to build large research groups to carry out cutting edge research, and use it to solve real-life industrial and societal problems. The institute runs many courses and research projects with its main focus on research. It aims to give the students the opportunity to interact with industry, prepare for entrepreneurship and also develop their personality.

IIITH today is one of the most well-known universities in the areas of research, and is among the best in the world in many of its research areas. But even with the institute’s right intentions, finding a good working relation with the industry is often very difficult. In recent years IIITH has experimented with few models that factor in the reality of academic environments- that faculty are driven by research and not products or markets.

IIIT-Hyderabad has already put in a few programs to bridge this gap between industry and academia. And one of the main things to do is to expand the horizon and look at applied research, build more real-world prototypes, have different types of outputs for the industry folks that can be easily understood and applied, do more work for licensing, etc.

Here we describe few key experiments being attempted at IIITH:

Discovery of technologies & opportunities

How does a potential consumer of research work know that such a work exists, and that it may help address their need? This discovery and connecting to a use case is the biggest challenge in industry adopting any of the academic research works.

Technology Catalogues- Simplify discovery of technologies

Today the only listing any research institution may have is a list of publications. These are often titled keeping peer research community in view, and often very esoteric in its wording. With focus being more on the research problem taken up and less on its possible uses. Can we get proactive and describe technology in adoption terms?

A technology catalogue, that describes the research work from usecases and utility standpoint, lists its technologies that can consumed by industry for a specific purpose or use-case.

Enhance this further through Prototypes

The research team brings out technology catalogues and prototypes, based on their research. The team, typically formed of the students from the 5-year programs are ideal, as they have enough knowledge of the research being done and also have access to startups with better understanding of how they work. Once the prototypes are built, they can be licensed and enterprises and startups requiring the technology can have immediate access to the technology.

Research reports

Regular research reports, barometers, workshops, and media releases for industry consumption – this ensures data is always contemporary and the research work being done by the university finds its way through for industry awareness.

Product labs: create product prototypes from research work

A key challenge that limits licensing possibilities is the presence of ready prototypes. The discovery of possibilities gets seriously restricted. Having market connected prototypes helps alleviate this constraint.

Enrich research lab experimental prototypes

Based on market research, identify opportunities for technologies being worked on in the research labs. Assist the labs in making their experimental code into demo’able prototypes. This increases the level of engagement when discussing licensing possibilities with potential licensee companies.

Create market prototypes of research output, thru Entrepreneur in Residence

If we can find an entrepreneur between ventures or a soon-to-be-entrepreneur to lead the efforts to create a market prototype, then this directly enables hiving the project as a startup, with the EIR taking it forward as a startup product post licensing.

Translating research- into market facing prototypes

This is a more direct approach to taking research into markets. Where either the research team is itself creating a startup from the work, or the research team is actively working with a company or a startup to create a market product out of the research work.

Research teams starting product startups

This is when technology entrepreneurs come out of research labs to form a startup. This is especially valuable since the entrepreneur has an understanding of research IP and then looks for fitting market product opportunities. This then leads to creating a startup with the MVP product.

Co-Innovation, create new tech prototypes with industry (labs knowledge, industry’s engineers)

In this model, the company comes ups with the problem, and provides a team that will build the product. The research team from IIITH helps research the technology. In this model, the company has access to deep technology and also professors and the research students, while not having to compromise on their proprietary data (with its own team building the product), and also has deeper understanding of the domain.

Co-creation or products with startups

This is essentially co-innovation with startups. Where a new product is created in the co-innovation mode. Essentially CO CREATING a startup product

Just Knowledge! Spicing up startups with research insights

Research applied need not always come only in the form of products or startups getting created from research work. Just the knowledge is also extremely useful to create better and deeper tech products.

Prototyping/hackathon events, to identify products based on research works

These can be a mechanism to crowd source meaningful products created out of research work. A topic/theme-specific hackathon where the research work and team is available for hacker-builders to come and create products out of research work/knowledge.

Bring your own project (BYOP)

At IIIT-Hyderabad, another great endeavor underway is to have product seeding in deep tech workshops. An extended deep tech how-to workshop, where teams bring their own project: product (BYOP). And all hands-on exercises in the workshop are on the participants projects. For example, when someone is building an NLP solution, join the NLP workshops organized by NLP researchers, and build the first version of the solution.

Student deeptech product ideas- DISHA

A program to help build the next big deep-tech startup. The selected deep-tech ideas will be nurtured and mentored by research fellows from IIITH Research Labs and Startup ecosystem partners of IIITH.

Invert it: ‘ADD’ research to startups

Yet another simple way could be to just add research advisory to startup acceleration and other pogroms. These are some activities underway at the IIITH incubator:

Avishkar – An acceleration program for startups working on AI, AR/VR, Robotics, Computer Vision, Machine Learning, NLP, and other deep tech technologies.

A Hardware Product Prototyping Accelerator program that helps build the next big Hardware Product startup.

Utsah – a monthly bootcamp series that facilitates this industry-academia synergy. This monthly bootcamp comprises architects and engineering leaders from organizations actively working on Intelligent Systems, and research scholars and faculty from multiple research institutions to help them exchange experience, insights, and also deliberate on the challenges.

FastApps Startup Accelerator – a 3-month structured program aimed at nurturing and empowering early entrepreneurs to convert their viable business ideas into tech-solutions. FastApps(Powered by WaveMaker), will be their tech partner for not just rapid prototyping but also to build the full solution.

Deep tech advisory (startups)

This method is when deep tech intelligence coming from research teams helps tailor solutions towards developing products. Researchers help covering technology studies, whitespace analysis, patent analytics, drafting, and research, etc. This when doubled with the companies’ knowledge of business research that is business-focused, objective, and often conservative view of market opportunities always brings great perspectives that can get missed in normal product development scenarios.

Industry angle- Teasers to connect industry success with research possibilities

Flow the “knowledge” from lab to land : Knowledge alone is also valuable

Nurture a Lab– Connecting corporates to latest emerging tech in the research labs

Companies can support research in a specific area and in return get access to interactions with faculty and researchers in the lab to stay connected with state of the art in that area. Emerging trends and research works.

Deeptech for strategy- senior leadership programs

A variation of the Nurture-a-lab, where short workshops are organized for senior leaders in industry to help them get a good view of emerging tech areas and trends. To help them in making technology strategy decisions and adoption of technology.

Deep dive tutorials/workshops

A research level approach is applied to deep-tech training in the industry. This is to build capability in new technologies and emerging tech areas, so industry can also build these solutions. This is to accelerate the process of industry engineers picking up new technologies and capabilities.

Path ahead

Many of the approaches discussed in this paper are being presently tested and piloted at IIIT Hyderabad. The results can be manifold – the academia benefits from understanding of the real world. The industry on the other hand gains thru new market opportunities explored by leveraging the state-of-art research being done in the academies. As the Indian tech industry actively seeks growth thru value creation, innovation and new tech products are imperative. And academic collaboration is key to making this happen. For which all present impediments have to be removed. The resulting synergy will lead to an unmatched technological innovation and collaboration eco-system.

A follow on analysis will be published by middle of 2018 with observations and results from various pilots underway.